It sounds great, but I doubt that anybody was brave enough and hold the portfolio during the last 4 years. Why? The one word answer is the volatility. The volatility is one of our biggest enemy in trading because it creates anxiety and pushing us to sell earlier the stock. If you look at below the chart you can see the Tesla’s price rallied and collapsed too many times. In the first six months gained 400% and then lost 40% within 10 weeks. In 2013 dropped from 200$ to 125$ - roughly 40% within two months.

Our hand and brain get nervous when we see as investor such great corrections. I am just asking you how you would behave at 40% correction. Are you sure about still holding the Tesla?

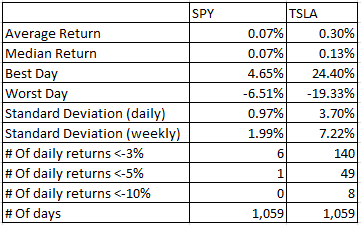

Tesla has made a great performance, but due to the volatility is almost impossible to hold for years. Check below the matrix and comparing the volatility to SP500. Closely 50 times happened a -5% or bigger daily drop. I am sure you would sleep well at those days.

All in all, the Tesla seems a great investment, but for me is more stressful than is reasonable and doesn’t worth for me the risk.

The BFM Assets Team.

No comments:

Post a Comment