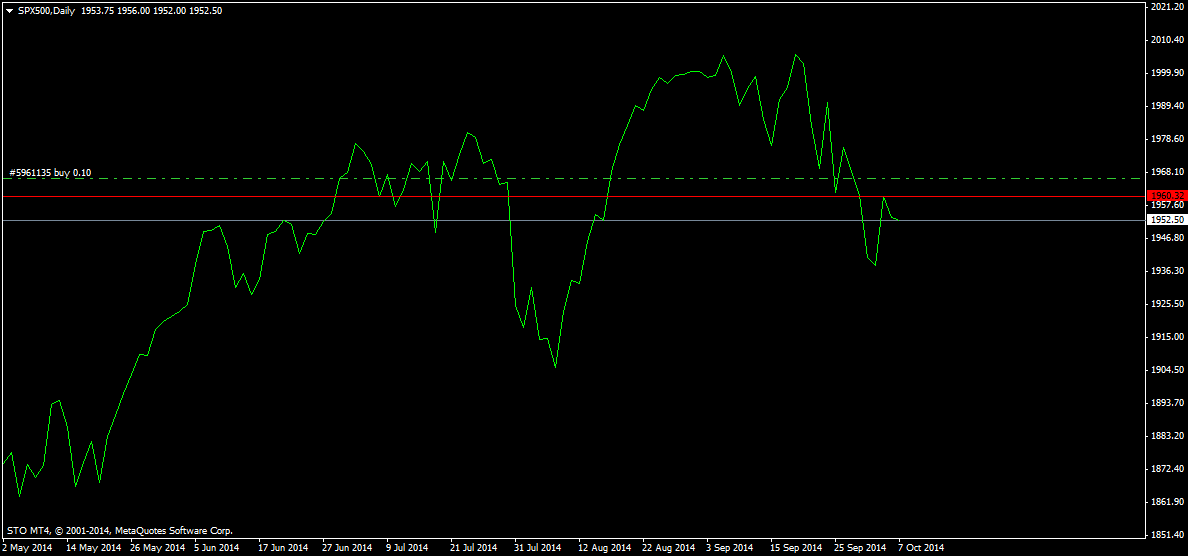

The sentiment of a typical investor is turned around in the last two weeks from super pessimism optimism. They had a panic sell at the dip in the middle of October. After their sell, close to the lowest points of the market they started only to buy in the last day and missed many profitable days. They all forgot again the number one rule of all markets „Buy low sell high”. They have done again the opposite as far as I read and see in the forums and different trading blogs. This chart below shows perfectly well how an average investor works.

You have to work contrarian like that mental approach if you want to be profitable. Don’t panic at sell-offs, try to ignore the pain of your loss. If you fell the pain you are overpositioned, so reduce your exposure. Those are inevitable rules being more successful in the trading arena.

The BFM Assets Team.